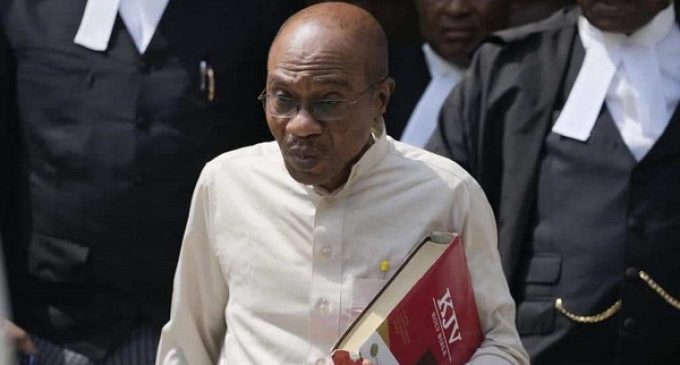

Former CBN Governor Godwin Emefiele and Minister to Face Trial Over N26.6 Trillion Fraud Scandal

Former CBN Governor Godwin Emefiele and Minister to Face Trial Over N26.6 Trillion Fraud Scandal

After a five-month investigation, the former Central Bank Governor, Godwin Emefiele, a minister, and 14 others have been recommended for trial over a massive fraud scandal amounting to over N26.6 trillion. The scandal involves former and serving top officials of the apex bank, with allegations ranging from fraud, forgery, stealing, diversion of funds, violation of the CBN Act, and more.

The scandal encompasses multiple dimensions, including the manipulation of “Ways and Means,” unauthorized investments, diversion of Naira redesign funds, mismanagement of COVID-19 intervention funds, and criminal activities in the Nigeria Electricity Supply Industry (NESI). Here are some key findings from the investigation:

- Manipulation of “Ways and Means”: Emefiele and his team could not produce evidence of “Ways and Means,” with the total standing at N26.627 trillion. There were instances of arbitrariness, unapproved withdrawals from the nation’s Consolidated Revenue Fund (CRF), and lack of presidential approval.

- Naira Redesign: The redesign of Naira notes was not approved by the CBN Board and President Muhammadu Buhari as required by law. Emefiele did not consult with the CBN management or seek recommendations from the Board. The redesign involved the printing of N1,000, N500, and N200 notes, costing N61.5 billion.

- Unauthorized Investments: Emefiele invested public money in 593 foreign accounts in the United States, China, and the United Kingdom without authorization, totaling billions of dollars. In the UK alone, he kept £543,482,213 in fixed deposits without approval.

- COVID-19 Intervention Funds: About N1.7 trillion spent on COVID-19 intervention management did not reach the right beneficiaries, with N1,622,119,412,095.16 allegedly transferred to various individuals and organizations.

- NESI Scandal: Emefiele was accused of unlawful manipulation of the approval of the President in the Nigeria Electricity Supply Industry. Fourteen Deposit Money Banks were involved in the criminal diversion of N17,232,349,193.55.

- Debentures Issuance by NESI Stabilisation Strategy Limited: NESI, supposed to be a Company Limited by Guarantee, was misrepresented and issued debentures. The Committee of Governors violated the CBN Act, authorizing the issuance of debentures leading to the diversion of funds.

The investigation also revealed Emefiele’s involvement in the printing of new notes, failure to consult with relevant authorities, and the diversion of funds in the NESI. The report highlights systemic infractions, misappropriation of funds, and abuse of office within the CBN during Emefiele’s tenure. The findings have prompted recommendations for the trial of those implicated in the scandal.

It is important to note that these allegations and findings are based on the results of the investigation, and legal proceedings will determine the guilt or innocence of the individuals involved.